Important Things to Know about Delivery Challan and Formats in India!

Learn how to streamline the transportation of your goods with delivery challans. Explore the components, format, and create best practices for delivery challan with GimBooks.

Delivery challans play a crucial role in various industries, including retail, manufacturing, e-commerce, logistics, construction, and healthcare. They help businesses track inventory, verify deliveries, and ensure compliance with regulations.

MSMEs need to transfer their goods to warehouses, and your goods might get lost or damaged in the process, to have proof that your goods were being transferred, your business needs a delivery Challan with delivery challan format.

A delivery challan helps you track and verify the details of your shipment. You need to issue a delivery challan when you are not supplying but transporting your goods from one warehouse to another. And if the goods being transported are not for sale, there is no need for a tax invoice. In that case, a business must use delivery challan instead.

Delivery challan is also known as a delivery slip or a dispatch slip.

According to Rule 55 (2) of the CGST Rules, the delivery challan should have three copies.

1. Original - for buyer

2. Duplicate - for transporter

3. Triplicate - for seller

With gst invoice manager, you do not need to create delivery challan separately for the buyer, transporter, and seller. Just tick on the check box against the original if you are sending it to the buyer, and tick on the check box against the duplicate if you are sending it to the transporter, and click on triplicate if you are sending it to the seller.

What is Delivery Challan?

The delivery challan's primary work is to acknowledge the delivery of the items to the warehouse or customer. It is sent along with the shipment of goods and a delivery challan format also contains information like the goods' recipient, locations, and delivery date.

According to Section 31 of the CGST Act 2017, a registered user, who transports taxable goods must submit a bill of sale with the amount and necessary information. Similarly, gst delivery challan is crucial for shipping and distributing goods.

Now that you know what is delivery challan is, let's understand the purpose and in which cases you need to issue a delivery challan.

Purpose and Use of Delivery Change

The purpose of delivery challan sample includes the following-

Tracking the goods during shipment:

It acts as proof of the goods being transported from one location to another. A delivery challan lists all necessary information like goods details, quantity, and other relevant characteristics. This helps to track the movement of goods and ensure they reach their intended destination.

Goods delivery verification:

Delivery challan acts as proof of delivery for both the sender and recipient. It allows the recipient to check items received against the mentioned details on the delivery challan. When an acknowledged copy is signed by the recipient, it is a confirmation of a successful delivery challan sample format.

Helps in internal processes:

It assists in various internal processes like inventory management, order fulfilment, and accounting. It helps update inventory levels, ensure the right deliveries with their orders, and facilitate accurate billing.

Regulatory compliance Fulfillment:

When tax implications are involved, delivery challan may be required by regulations for transporting goods in certain cases.

Now, when the purpose of a delivery challan is fulfilled, you need to understand in when you can issue a delivery challan.

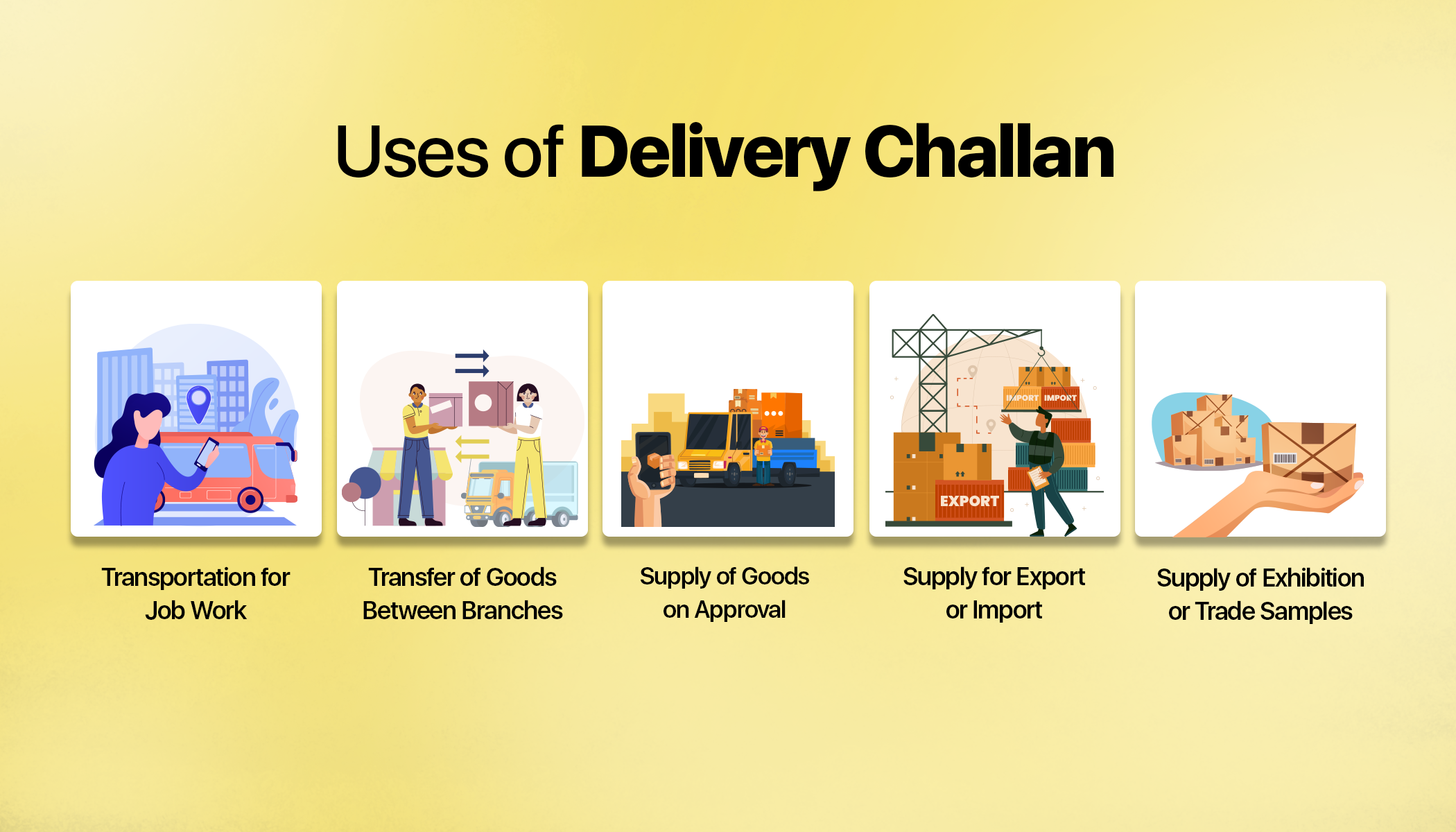

Transportation for Job Work

When goods are sent to a job worker for further processing, repair, or any other treatment, a delivery slip is issued instead of a tax invoice. The goods are returned to the sender after the job is completed.

Supply of Exhibition or Trade Samples

When goods are sent for display in exhibitions, trade fairs, or as free samples, a delivery challan is issued to enable their transportation without a tax invoice.

Transfer of Goods Between Branches

When goods are transferred from one branch to another within the same company, a transport receipt is issued to record the movement without raising a tax invoice.

Supply of Goods on Approval

In situations where goods are sent on an approval or sale-or-return basis, a delivery slip is used to move the goods without a tax invoice until they are accepted by the recipient.

Supply for Export or Import

For the export or import of goods, a delivery challan is used to move the goods from one location to another without a tax invoice.

A delivery challan ensures a smooth and accurate delivery of goods, streamlining internal functions, and complying with regulations. Its specific use depends on the type of the transaction and the applicable regulations.

Use case of Delivery Challan in various industries

The use of delivery challans extends across diverse industries due to their flexibility in tracking and verifying goods movement. Here is how delivery challan is used across various industries-

Retail

When you are delivering products to stores or customers, a delivery challan ensures accurate product quantities and descriptions match the order.

Trading & Manufacturing

In the manufacturing industry, delivery challan sample allow you to track part of goods or raw materials being delivered between production to transporting it to the suppliers.

E-commerce

Online retailers require delivery challan to accompany deliveries, verifying the items ordered and received by the customer.

Logistics and Transportation

Delivery Challans help in goods transportation by third-party logistics providers, ensuring transparency and accountability.

Construction

Delivery Challans track building materials delivered to construction sites, verifying quantities and specifications.

Healthcare

Delivery Challans help in inventory management for medical fields by tracking medical supplies and equipment delivered to hospitals and clinics, ensuring proper stock management and recording.

By understanding the purpose and various use cases of delivery challan and trying different delivery challan samples for each industry. By doing so, you can leverage customer satisfaction with this valuable tool to ensure smooth, efficient, and compliant delivery operations.

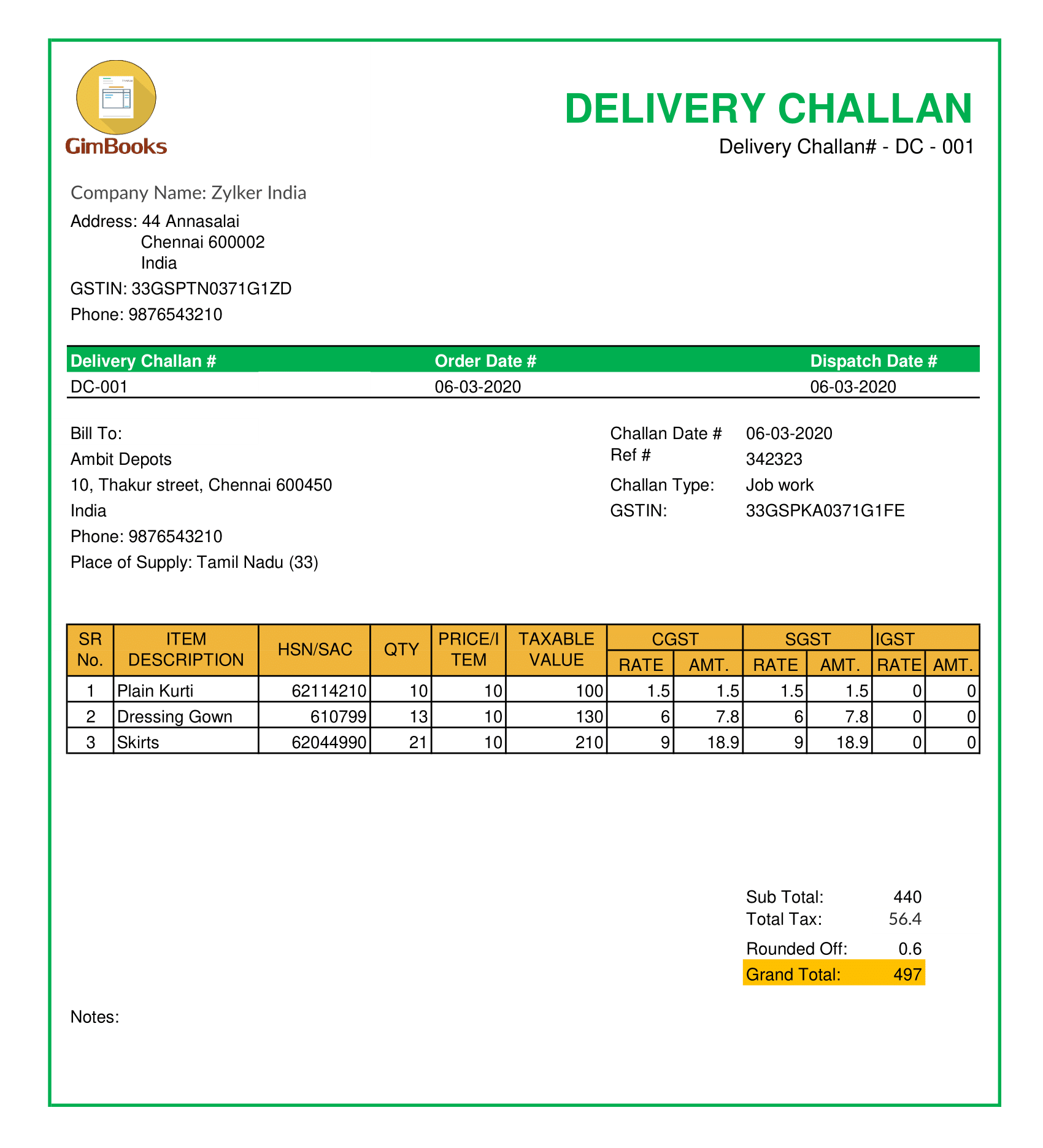

Components of a Delivery Challan

Important Components of a Delivery Challan include:

Identification

Delivery Challan Number and Delivery Challan Prefix: Unique identifier for the document.

Date: Date of issuance.

Parties Involved

Consignor: Information about the sender (name, address, GSTIN if applicable).

Goods Information

Description: Clear and detailed description of each item/good being delivered.

Quantity: Unit count of each item/good.

HSN Code: Harmonized System Nomenclature code for each item (required for tax purposes).

Rate (Optional): Price per unit (not always included).

Payment Mode: Whether it is a cash sale

GST Treatment Type: Whether the consignee has a registered business, unregistered business, consumer, overseas / export, or SEZ.

Total Amount (Optional)

Total value of each item (calculated if rate is included).

Additional Information

Place of Supply: Location where goods are delivered (relevant for tax purposes).

Transportation Details (Optional): Carrier information, vehicle number, WE-WayBill no. freight charge, insurance charge, loading charge, packaging charge, etc.

Tax Details (if applicable): GST rate, IGST, CGST, SGST, Cess (for India).

Other Details: Original, Duplicate, Triplicate as per 55 (2) of the CGST Rules.

Signature

Authorized representative's signature for confirmation.

A delivery challan plays an important role in ensuring smooth and accurate delivery of goods, streamlining internal functions, and complying with regulations. Its specific use depends on the nature of the transaction and the applicable regulations.

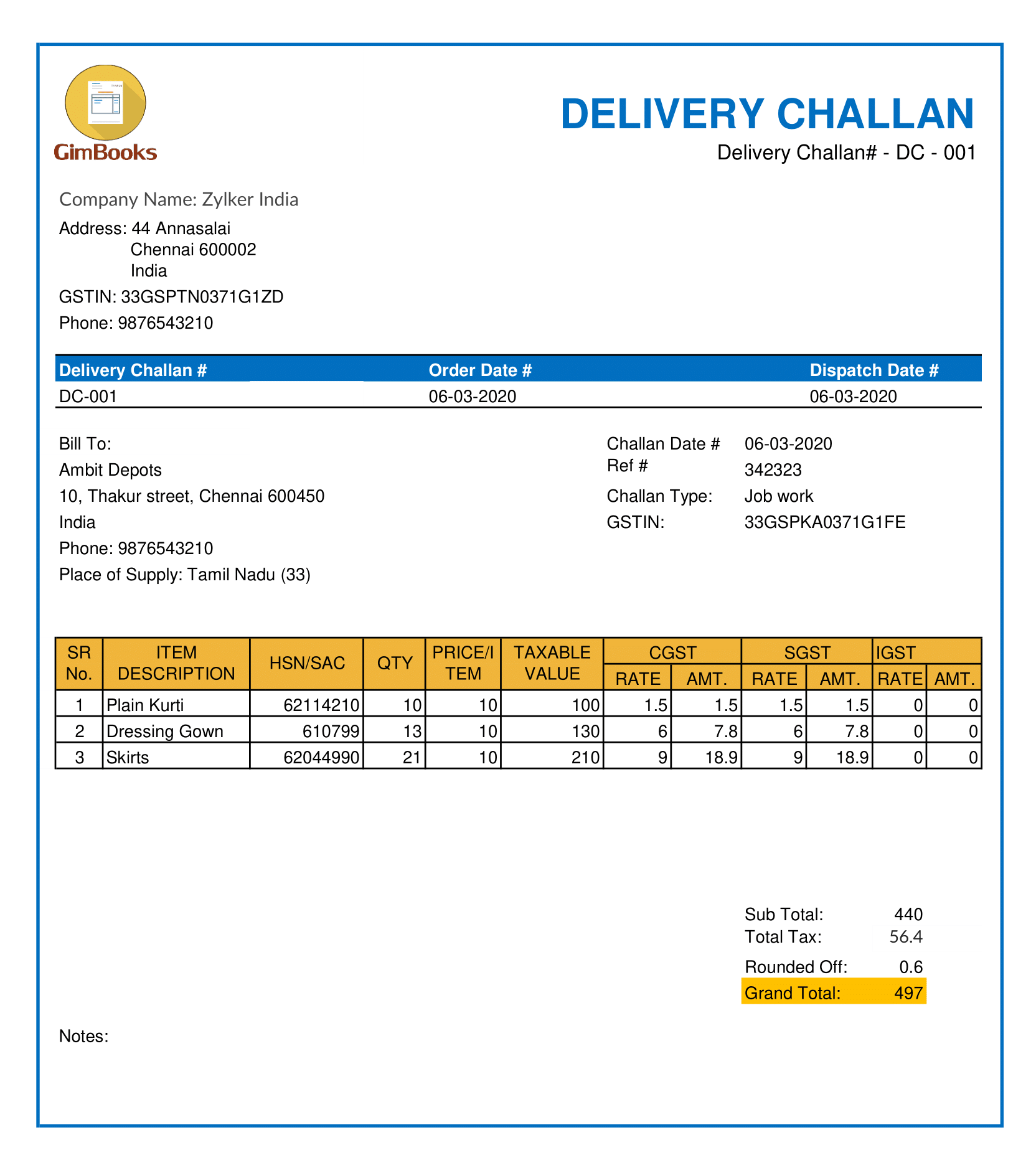

Different Formats and Templates

A standard format includes standard delivery challan sample with delivery challan format includes company details, name, address, and contact information, challan details, consignee details: name, address, and contact information of the recipient, product details, transport details: mode of transport, vehicle number, and driver's name, other information: signature of an authorized person, any special instructions.

The format can be modified as per the nature of the transaction, it can be made on an Excel sheet, traditional, and more. Let’s understand it below-

Excel Delivery Challan Template

You can create a delivery challan template in Excel for easy data entry and calculations. This is a good option if you do not want to pay for a delivery challan software.

Digital Delivery Challan Template

Professional delivery challan software can help create a customised and professional delivery challan template, that is visually appealing, reflects your brand identity, industry, and nature of your work, and allows you to add all the required details for transportation of goods.

Word Delivery Challan Template

You can also create a delivery challan template in MS Word. This is a good option if you want to create a delivery challan with a few graphics and add your branding.

Printable Delivery Challan Templates

If you feel hesitant about trying digital delivery challan, you can print your delivery challan templates or buy the ones that are available offline.

You can search online or go for a printed delivery challan to find a template that meets your needs.

Best Practices for Filling Out a Delivery Challan

Best practices for filling out a delivery challan include the following-

Understandable and clear language

Maintain information, and organised the template for better readability so that the delivery challan is clear and easy to understand.

Pre-filled templates

Save time by using pre-filled delivery challan templates with company and product information.

Automatic calculations

Reduce errors with automated calculations for quantities, totals, and taxes. Use software that calculates updated tax charges.

Cloud-based software

Integrate delivery challan format data with accounting software for a streamlined process, allowing you to access your delivery challan anywhere, anytime.

By following these comprehensive best practices, you can create appealing, informative, and legally compliant delivery challan sample that contribute to smoother deliveries and better business operations.

Conclusion: Make Best Delivery Challan with GimBooks

Understanding the significance of a Delivery Challan and its various components is important for small businesses, especially MSMEs. The Delivery Challan serves as an essential tool for tracking, verifying, and confirming the delivery of goods, facilitating internal processes, and ensuring regulatory compliance.

By incorporating best practices in filling out a delivery challan, such as clarity, pre-filled templates, automatic calculations, real-time tracking, and the use of cloud-based software, businesses can enhance efficiency and accuracy in their delivery operations.

And GimBooks App offers a comprehensive solution for creating the best Delivery Challans, ensuring smooth and compliant delivery operations for businesses. Leveraging this valuable tool can lead to increased customer satisfaction and streamlined business processes.

Also check - Learn How to create Delivery Challan using Gimbooks App

FAQ- More about delivery challan

What is a Delivery Challan?

A delivery challan is a commercial document issued by the supplier (consignor) to the recipient (consignee) when goods are transported from one place to another. It serves as proof of delivery and contains details about the goods, quantities, and other relevant information.

Is Delivery Challan Mandatory under GST?

Yes, a delivery challan is mandatory under GST when the supply of goods is not accompanied by a tax invoice. It's essential for record-keeping and tax purposes.

What are the Key Components of a Delivery Challan?

A standard delivery challan should include:

- Unique serial number

- Date of issuance

- Consignor's details (name, address, GSTIN)

- Consignee's details (name, address, GSTIN)

- Description of goods (HSN code)

- Quantity and value of goods

- Place of supply

- Transportation details (optional)

- Signature of the authorized person

What is the Difference Between a Delivery Challan and a Tax Invoice?

A delivery challan is a document acknowledging the receipt of goods, while a tax invoice is a commercial document issued for a sale of goods or services. A tax invoice includes the final value of goods including taxes, while a delivery challan may not.

Can I Use a Delivery Challan for Input Tax Credit (ITC)?

No, a delivery challan cannot be used as a basis for claiming input tax credit. Only a tax invoice can be used for ITC.

Is There a Specific Format for a Delivery Challan?

While there is no prescribed format, the delivery challan must contain the essential information mentioned above. The format can vary from business to business.

Do I Need to Generate an E-way Bill for a Delivery Challan?

Yes, if the value of goods exceeds the prescribed threshold for e-way bill generation, you need to generate an e-way bill along with the delivery challan.

Can I Generate a Delivery Challan Online?

Yes, many accounting and billing software solutions offer the option to generate delivery challans electronically.

What happens if I don't issue a delivery challan?

Failure to issue a delivery challan can lead to penalties and legal issues. It's essential to maintain proper documentation for tax and audit purposes.

How many types of delivery challan are there?

There 3 types of delivery challans including job work challan, sales return challan, and stock transfer challan.

What is the difference between waybill and delivery challan?

A waybill focuses on the transportation aspect of the goods, while a delivery challan is more concerned with the transfer of ownership and tax implications. In many cases, a delivery challan may accompany a waybill to provide additional information about the goods being transported.

What is the rule 55 of challan?

Rule 55 of the CGST Rules outlines the conditions under which a delivery challan can be issued in lieu of a tax invoice for the transportation of goods. This rule primarily applies to situations where the nature of the transaction doesn't necessitate a regular tax invoice.

How many copies of the delivery challan should be prepared?

According to Rule 55 (2) of the CGST Rules, the delivery challan should have three copies.

1. Original - for buyer

2. Duplicate - for transporter

3. Triplicate - for seller

More on delivery challan-

GimBooks Delivery Challan | Delivery Challan format

GimBooks delivery challan format in word, excel, and pdf

Delivery challan gimbooks

Delivery challan template | delivery challan format

Ewaybill from delivery challan

.jpeg)