E-Way Bill Updates 2025: New Rules Every Business Must Know

Latest GST compliance updates for E-Way Bills in 2025: Higher threshold (₹75K), extended validity & stricter driver checks. Stay penalty-free with GimBooks!

Running a business in India isn't easy—especially an MSME— Tricky compliance and complex new rules add more stress for SMB owners in India. And guess what? The E-Way Bill updates for 2025 have been rolled out each month, and they’re more than just minor changes.

The new E-Way Bill rules directly affect day-to-day operations, especially if you're into logistics, manufacturing, or retail. So let’s get started with these E-WayBill updates for MSMEs and SMBs.

Why the new E-Way Bill Updates Matter to Indian MSMEs

Key E-Way Bill Updates and new e-waybill rules announced in 2025-

- 180-day Limit: This new E-Way Bill part b update can only be generated for documents dated within 180 days (e.g., after Jan 1, 2025, documents before July 5, 2024, are ineligible).

- 360-day Extension: Validity can be extended for the next 360 days from the day of e-waybill generation as per the e-waybill Part B update.

- MFA Mandatory: Required for all taxpayers/users from April 1, 2025.

- E-Invoicing Thresholds: Lowered to ₹10 Cr+ AATO (from ₹100 Cr+), with invoices to be uploaded within 30 days.

- ISD Registration: Mandatory for businesses with multiple branches from April 1, 2025.

- 2FA- 2-factor authentication is required for logging in e-invoice and e-waybill portal.

- Revised MFA AATO Limits:

- ₹20 Cr+ from Jan 1, 2025

- ₹5 Cr+ from Feb 1, 2025

Why You Shouldn't Ignore New E-Way Bill Rules 2025

Real-Time Syncing With GSTN

The GSTN system now receives E-Way Bill updates for data instantly. That means less manual intervention but also tighter scrutiny.

Automated Penalty Triggers for Non-Compliance

Per the new E-Way Bill rules 2025, delay in updating vehicle details or failure to generate an E-Way Bill on time now triggers automatic penalty notices.

Penalty Slabs Revised in E-Way Bill Rules

Penalties for non-compliance have doubled in some categories. For example, transporting without an E-Way Bill can now attract a fine of ₹20,000 or more as per the new e-way bill rules 2025.

Sector-Specific Impact of New E-Way Bill Rules 2025

New E-way bill rules and updates have brought changes for the following sectors:

Manufacturing

Expect tighter checks at factory gates. If your dispatches don't match with e-invoices and E-Way Bills, you’re in for trouble. Keep up with e-way bill updates.

Retail & Wholesale

Even small B2B shipments need proper documentation, so follow the new e-way bill rules and e-way bill updates. Thresholds are lower, and random checks are more frequent as per the e way bill part b update.

Check for gold & precious stones

Logistics Providers

Fleet tracking and vehicle detail updates are non-negotiable. If you're not GPS-enabled, you're already behind with transport regulations, too.

How E-WayBill Changes Affect Indian MSMEs and SMBs

The e-way bill updates are complex, especially for small businesses. But on the other side, if you invest in automation now, audits will be easier, and you'll save time long-term. Here’s a list of how your business can be affected by state-wise e-waybill notification-

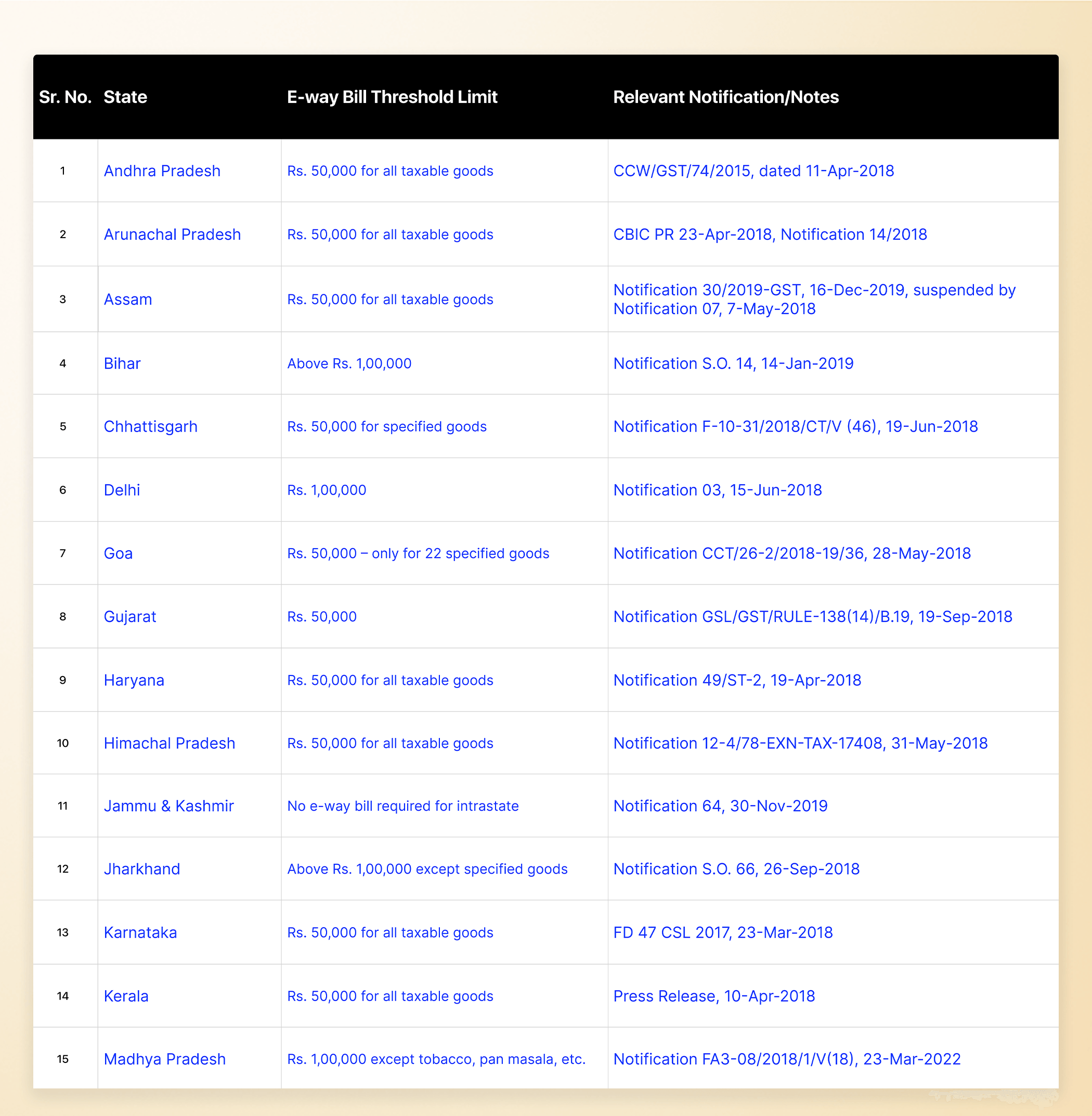

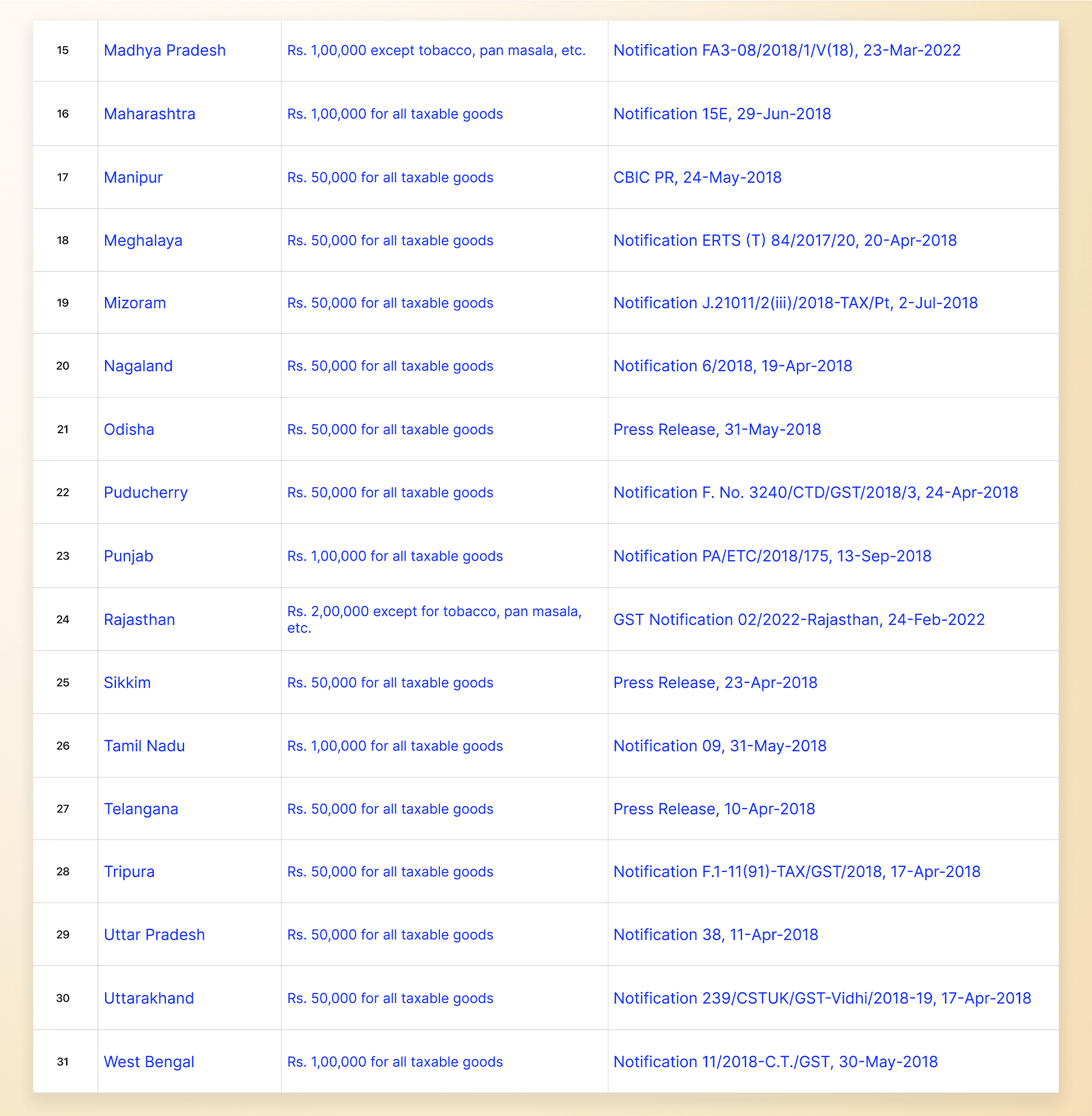

E-Way Bill Threshold Limit for Intrastate Movement of Goods

Here is a list of the e-way bill threshold limits for each state's intrastate movement of goods.

Key Government Notifications To Be Aware Of

The CBIC has released detailed circulars explaining each update. Look out for:

- Notification No. 04/2025 – Central Tax,

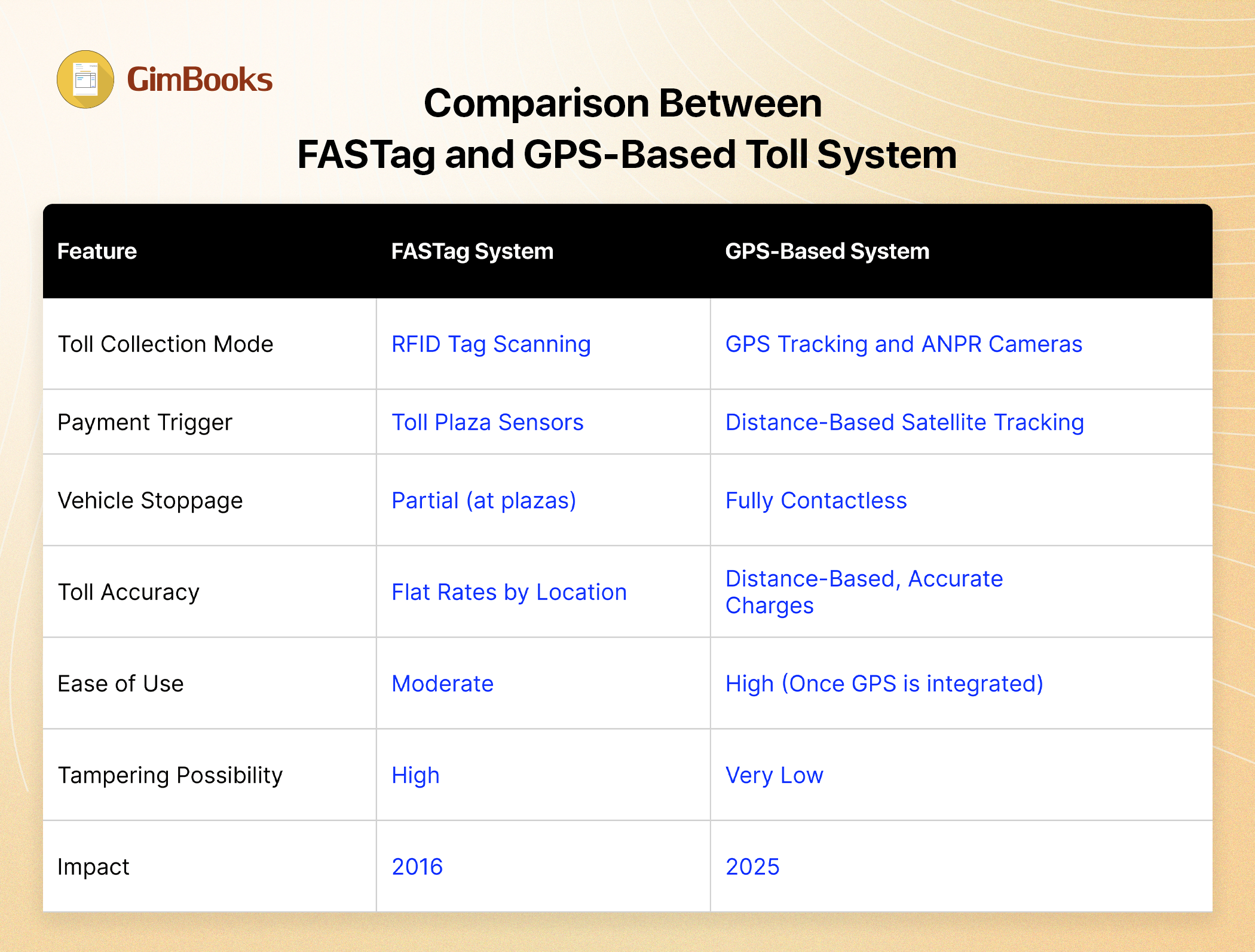

- Advisory on FASTag-GST integration, GPS-based toll system.

The new toll system will first roll out across major national highways, especially in high-traffic corridors.

Likely Highways Covered in Phase 1:

-Delhi-Mumbai Expressway

-Bengaluru-Chennai Highway

-Golden Quadrilateral Corridors

-Delhi-Kolkata National Highway

-Eastern and Western Peripheral Expressways

This change towards GPS-based toll system is a major step for a developed, digital highway infrastructure. It is expected to save fuel costs, reduce traffic congestion, and offer a fairer toll payment model for all road users.

- State-wise E-Way Bill thresholds (some are different!)

We share all updates for MSMEs and SMBS in our WhatsApp channel, join us!

What are the 2025 E-Way Bill changes?

Real-time syncing with GSTN is active, vehicle updates must be done within 4 hours, and e-invoicing is mandatory for E-Way Bill generation in e way bill part b update.

Also read- Make e-waybill from delivery challan easily

Mistakes to Avoid With the New E-Way Bill Rules

Failing to Update Vehicle Details Within the New Time Limit

The E-Way Bill updates 2025 require vehicle numbers to be updated within 4 hours of dispatch. Delays can lead to auto-generated penalties or shipment holds as per the new E-Way Bill rules.

Generating E-Way Bills Without E-Invoices

Since e-invoicing is now mandatory as per GST compliance updates, you can’t generate an E-Way Bill unless the invoice is first validated through the e-invo

icing system as per the e way bill part b update.

Ignoring Part-B of the E-Way Bill

Many businesses skip filling out Part B (vehicle details) or leave it incomplete. In 2025, an incomplete Part B means your E-Way Bill is invalid. So, follow the new e-way bill rules for e way bill part B update.

Using Expired or Incorrect E-Way Bills

Each E-Way Bill now has a category-based validity (e.g., perishable vs. non-perishable goods). Using expired ones or reusing old ones can trigger fines as per transport regulations. Don’t forget to keep up with the new e-way bill rules 2025.

Manually Entering Wrong Data

Small typos in invoice numbers, transporter ID, or GSTNs can lead to data mismatches when synced with GSTN—and red flags during audits via e-way bill notifications.

Transporting Goods Without an Active E-Way Bill

Whether intentionally or by oversight, transporting without a valid e-way bill rules leads to detention of goods, fines, and sometimes seizure.

Overlooking Exemptions and Special Cases

Businesses often miss out on exemption rules (like for job work or handicraft goods). Not knowing them can result in unnecessary E-Way Bills or missed compliance.

Failing to Train Your Staff

Staff unaware of the e-way bill updates may follow old government notifications and rules. Without proper training, your team becomes a liability, not an asset.

Not Using Updated Compliance Software

Outdated tools may not sync with the latest GSTN systems or fail to flag missing details, leading to unintentional violations. Using software that follows GST compliance and e-invoice, and e-waybill updates helps you stay penalty-free.

Assuming State Rules Haven’t Changed

Some states have introduced new E-Way Bill rules, state-specific thresholds or notifications. Following central rules only might leave you non-compliant locally.

How to Stay Compliant in 2025

Digital Tools and Automation-

Invest in GST software that auto-generates E-Way Bills from invoices. Don’t rely on manual entry—it’s error-prone and outdated.

Read more: Make E-Way Bill Online

Best Practices for Documentation and Filing-

Maintain updated vendor and transporter databases according to transport regulations

. Upload vehicle info and transport details without delay.

How to Train Your Staff-

Keep your staff updated with your business news. Make sure your logistics and accounts departments are aligned.

Tips for Smooth Implementation of the 2025 E-Way Bill Updates

Here’s how you can easily implement e-way bill updates and be more efficient:

1. Create Clear Internal SOPs (Standard Operating Procedures)

Document every step of your E-Way Bill process—from invoice generation to vehicle dispatch. It will help you to:

-Avoid confusion among staff members.

-Reduce dependency on specific team members; it helps you run business operations smoothly.

-Ensure everyone follows the e-way bill updates, so you never have to pay a penalty or extra.

✅Include it for emergency scenarios too, like vehicle breakdowns or last-minute changes in dispatch.

2. Regular Compliance Audits

Set a schedule (monthly or quarterly) to:

-Review E-Way Bill generation records.

-Cross-check them against e-invoices

-Flag inconsistencies or missing data

✅ Use GST-compliant software to create compliant e-waybills.

Get free ewaybill template !

3. Keep Your Staff up with the latest E-Way Bill updates

The 2025 updates are a significant shift. Make sure your accounts, dispatch, and logistics teams:

-Understand GST compliance updates and new E-Way Bill rules.

-Know how to use the updated software

-Are aware of new penalties and validity rules

✅Use simple role-based training. Don’t overload everyone with information that doesn’t apply to their work.

Read more: Waybill updates in 2024

4. Invest in E-Way Bill Automation Tools

Don’t try to manually create or track hundreds of E-Way Bills. Use software that:

-Auto-generates E-Way Bills from e-invoices

-Validates data in real-time

-Updates vehicle and transporter info with a few clicks

✅Choose tools that are GSTN-approved and mobile-friendly.

5. Set Up Real-Time Communication Channels

Delay in updating the transporter details? Missed vehicle number entry? These slip-ups happen when there's no direct communication between your accounts and logistics teams.

✅Use tools like WhatsApp group, or simple mobile apps to keep everyone in the loop instantly.

6. Assign a Dedicated Compliance Owner

Appoint someone in-house or outsource to a GST consultant. They’ll be responsible for:

-Keeping track of new notifications

-Overseeing the implementation of new rules

-Act as a single point of contact for all compliance issues

✅Don't assume your CA will catch every small operational detail—someone internal is still needed.

7. Keep a Digital Backup of Every E-Way Bill

Accidental deletion or system crashes can get you in trouble during audits. Always:

-Store E-Way Bills in cloud drives

-Use folders by month/dispatch type

-Ensure access controls to avoid accidental edits/deletions

✅Set automated backups if your software allows it.

8. Stay Updated With Official Notifications

The government keeps tweaking things. Subscribe to:

-GSTN newsletters

-CBIC Twitter/X handle

-Telegram groups or GimBooks WhatsApp Channel

✅Bookmark the https://ewaybillgst.gov.in portal and check once a week.

By following these tips, you’re not just avoiding penalties—you’re future-proofing your operations for a more digital, faster-moving compliance environment.

Smart tools for Simplifying E-WayBill Compliance

Use smart tools for e-way bill and GST compliance updates like:

✅ TallyPrime

Trusted by lakhs of Indian businesses.

- Seamless E-Way Bill creation from invoices.

- Smart syncing with e-invoicing and GSTN.

- Supports multi-state operations with ease.

✅ ClearTax GST

Great for high-volume businesses.

- Auto-generates bulk E-Way Bills, with built-in validation.

- Real-time alerts for missing Part-B or expired bills.

- Simplifies GST filing, e-invoicing, and reconciliation—all in one place.

✅ Zoho Books (E-Way Bill Module)

Perfect for businesses that want accounting + compliance in one tool.

- Lets you generate, push, and track E-Way Bills with ease.

- Fully mobile-friendly and GSTN-integrated.

Which is the easiest E-Way Bill software for small businesses in India?

✅ GimBooks (Best for Small and Growing MSMEs)

It is a cloud-based accounting and invoicing software that helps MSMEs create GST-compliant business invoices and 25+ documents. It is made specifically for Indian small businesses, especially those new to digital compliance.

- Easy interface for E-Way Bill generation and is equipped to e-way bill updates.

- It auto-calculates tax, validates data, and shares transporter info in real time.

- Offers features like digital invoicing, e-invoicing, inventory tracking, and mobile app access.

- Works well in both English and regional languages, making it ideal for small businesses.

- Using GimBooks, you can convert an invoice to an e-way bill in 1 click!

Look for a tool that follows e-waybill updates

Conclusion

The E-Way Bill updates for 2025 aren’t just rule changes—they’re a shift in how MSMEs manage logistics, compliance, and operations. It might seem overwhelming at first, but with the right tools and approach, it’s manageable.

Start small. Get your software in place, update your SOPs, and train your team. You’ll thank yourself later.

Download e-Way Bill compliant GST billing software to simplify your business accounting and invoicing needs.

FAQs

1. Do I need to generate an E-Way Bill for goods below ₹50,000?

Only if they fall under specific categories like electronics, pharma, and precious metals.

2. What happens if I don’t update the vehicle number within 4 hours? You may face penalties, and your consignment could be flagged during transit.

3. Can I still generate an E-Way Bill without an e-invoice?

Nope. E-invoicing is now mandatory for E-Way Bill generation in most cases.

4. Are these updates the same across all Indian states?

Mostly yes, but some states may issue their thresholds and timelines.

5. How can I automate E-Way Bill generation?

Use GST-compliant software that integrates with your invoicing system and syncs directly with the GSTN.