HSN Code List And GST Rate Finder: Important Facts You Should Know

Wondering what an HSN Code is and how to find one using an HSN Code finder? This article answers all of your questions. Continue reading to learn more about the HSN Code list.

We have sought to solve the most common questions. Let's start with an explanation of what the HSN Code is...

What Is HSN Code?

Do you know what the full form of HSN Code is?

The Harmonised System of Nomenclature (HSN) abbreviates the Harmonised System of Nomenclature. Both B2B and B2C tax invoices on the supply of goods and services are required to include this information. The World Customs Organization first implemented this in 1988. (WCO). This was created to classify things methodically, both domestically and internationally. This is a six-digit code used to categorise items. Since 1986, India's Customs and Central Excise departments have used HSN numbers to classify goods. Customs and GST both have HSN codes. GST uses the same codes as the Customs tariff. HSN is a popular television network that is broadcast worldwide. Various commodities have distinct HSN codes. HSN codes do away with the requirement to provide product information, making claims filing easier.

Importance Of HSN Code

The HSN Code is important in a variety of ways; some of them are listed below:

1. The HSN Code Finder is a practical technique of identifying commodities for domestic and international trade because the HSN code is accepted internationally for classifying things.

2. The HSN code is used to collect data and better understand international and domestic trade.

3. As a result, it will assist the government in formulating macroeconomic policies concerning the trading of these commodities.

Uses Of HSN Code

HSN codes are used to make GST more methodical and universally acknowledged. HSN codes eliminate the need to supply a full product description. Because GST returns are computerised, saving time and making filing easier.

How Does HSN Code Work?

HSN is a six-digit number that organises over 5000 products into a legal and logical hierarchy. The HSN is supported by well-defined regulations and is widely accepted to ensure uniform classification.

The HSN classification is frequently used for taxation purposes since it aids in determining the tax rate that applies to a certain product in a given jurisdiction. It can also be utilised in computations involving benefit claims.

This isn't all, though; it also applies to imports and exports. The HSN code is used to determine how many things are imported or traded inside a country.

Why Is HSN Code Important?

While the HSN code's primary purpose is to classify items systematically, it can also be used to collect data and solve problems that would otherwise be impossible to solve. As a result, the international trading system is more efficient.

HSN is used in almost 200 countries around the world. This high adoption rate can be attributed to HSN's advantages, which include:

1. International trade statistics are collected.

2. Creating a reasonable foundation for customs charges

3. consistent Classification

HSN is used to classify about 98% of worldwide trade stock, confirming its reputation as the best form of international categorisation.

Every country has an HSN number for each commodity, and the number is nearly the same for practically all goods. Because HSN numbers are solely based on the commodities categorised, they can vary a little in various nations.

Why Is HSN Code Used/Required?

HSN codes are used to make GST more methodical and widely recognised. The use of HSN numbers eliminates the requirement to upload a full product description. Because GST returns are computerised, this will save time and simplify filing.

HSN Code In India & Worldwide

HSN Code In India:

The World Customs Organization (WCO) has recognised India as a member since 1971. It is used to classify Customs and Central Excise commodities using 6-digit HSN codes. Customs and Central Excise later added two extra digits to the numbers to make them more exact, resulting in an eight-digit categorisation.

Getting to Know the HSN Code

1. The HSN is divided into 21 parts, each with 99 chapters, 1,244 headings, and 5,224 subheadings.

2. There are Chapters in each Section. Headings are used for splitting each Chapter. There are Sub Headings under each Heading.

3. Headings and subheadings explain products in detail, while section and chapter names define broad groups of goods.

HSN Code In Other Countries:

In other countries, the HSN code is known by various names, but its sole purpose is to define an item in the export-import industry. So, let's look at what other countries' HSN codes are called.

- HS Code in Vietnam: Vietnam employs CTC (Custom Tariff Code) up to 8 numbers to characterise every commodity in the export-import sector.

- HS Code in Indonesia: The HS Code is BTKI (Buku Tarif Kepabeanon Indonesia), with up to eight digits to describe a business item.

- HS Code in the United States of America: The HTS (Harmonized Tariff Schedule) codes of up to ten digits are used to classify any product with higher specifications.

- HS Code in China: The HSN Code can be up to 8 digits long; however, most products are categorised up to 10 digits long. This code is also known as Custom Tariff Code in this country.

- HS Code in Brazil: In Brazil, this code is referred to as NCM (Nomenclatura Comum Do Mercosul). It can be utilised up to eight digits for selling and buying things locally and for international trade.

Understanding The HSN Code

Getting to Know the HSN Code. So, what is the complete HSN code? The HSN code contains the following information:

- There are 21 sections in total.

- There are 99 chapters in total.

- There are 1244 headings in total.

- There are 5224 subheadings in total.

- The HSN code is divided into 21 groups, each of which is further divided into 99 chapters. After then, the chapters are divided into approximately 1244 headings. The heads are then subdivided into 5224 subheadings.

The following is how it works in the code:

- A two-digit HSN number is assigned to each Chapter.

- Each two-digit HSN number is converted into a four-digit HSN code.

- These four-digit HSN codes are then further subdivided into six-digit HSN codes.

How can I locate my HSN code, which is eight digits long?

An additional two-digit HSN code is required to sub-classify the six-digit code number in some countries, resulting in an eight-digit HSN code.

What Is Services Accounting Code (SAC) In GST?

The SAC or Services Accounting Code is a categorisation system established and released by the (CBIC) Service Tax Department of India to classify various services. SAC codes categorise services to improve service measurement, taxation, and recognition. The central board of excise and customs (CBEC) is in charge of these codes.

SAC (Services and Accounting Code) codes are based on the Harmonized Standard of Nomenclature, a globally recognised system for classifying and codifying all items. This technology allows for GST compliance following international norms. It will offer the government a standard structure for effectively coordinating and analysing data connected to sales and purchases.

HSN Code In GST

HSN Codes were previously only applicable to Central Excise and Customs, but since the advent of GST, businesses must now include HSN Codes in their tax invoices and disclose them in their GST filings. In addition, the CBIC has reported GST rates based on the HSN classification of commodities. As a result, to determine the GST Rate for your product, the business must first discover the relevant HSN Code. The Central Board of Indirect Taxes ("CBIC") had previously announced the following provisions relating to the HSN Code under the GST:-

HSN Codes are not required to be mentioned if the annual turnover is less than or equal to Rs 1.5 crore.

1. Annual Turnover of 1.5 to 5 crores - HSN Code of up to two digits must be mentioned.

2. If your annual turnover exceeds Rs. 5 crores, you must include your HSN code, which can be up to four digits long.

Beginning April 1, 2021, the aforementioned notification has been modified to demand 4/6-digit HSN Codes on tax invoices for products provided.

1. The previous year's total revenue was up to Rs. 5 crore - HSN Codes of up to four digits must be mentioned.

2. The previous year's total turnover was more than Rs.5 crore - HSN Codes of up to 6 digits must be mentioned.

In addition, the following points should be noted:- The necessity to disclose 4 digit HSN Codes is not mandatory for B2C firms with a turnover of less than Rs. 5 crores. Still, it is compulsory for B2B businesses.

For any business participating in import-export operations governed by Foreign Trade Policy and customs rules, all invoices and customs documents must include the 8-digit HSN Codes or HS Codes as announced by the DGFT.

Declaration Of HSN Code For Goods And Services

HSN code must be mentioned on all tax invoices from April 1, 2021. The use of HSN codes on all tax bills will be a major compliance requirement from April 1, 2021.

Important Characteristics:

1. In the interest of taxpayers (with a total annual turnover of more than Rs. 5 crores in FY 2020-21), all tax invoices must include the HSN Code for Goods and Services' six digits.

2. For the benefit of taxpayers (with aggregate Annual Turnover up to Rs. 5 Crore during the FY 2020-21) HSN Codes for Goods and Services must be specified in B2B Tax Invoices by 4 digits. 4 digits of HSN Code for Goods and Services in B2C Tax Invoices to be mentioned on an optional basis.

3. 8 numbers must be included in export invoices, and it is also a requirement under Foreign Trade Policy

4. 49 chemicals, as per Notification No. 90/2020 dated 01/12/2020, must be shown mandatorily under the 8 digits code.

5. Minimum digits must be reported in Table 12 of GSTR 1 and on the Tax Invoice.

6. Under section 125 of the GST Acts, there is also an Rs fine. 50,000/- (Rs. 25,000/- under each CGST + SGST Acts) for making a mistake connected to this scenario.

7. To increase transparency and avoid future litigation, all tax invoices should include HSN digits, a description of the items, and tax rates.

Why Is HSN Important Under GST?

HSN codes are used to make GST more methodical and universally acknowledged. HSN codes eliminate the need to supply a full product description. Because GST returns are computerised, saving time and making filing easier.

Difference Between HSN Code And SAC Code

The fundamental difference between HSN and SAC codes is that the former identifies commodities while the latter is used to identify services. Another distinction is the number of digits in the code; for example, HSN numbers have eight while SAC numbers have six.

HSN - Wise Summary Of Outward Supplies

A registered dealer is required to furnish an HSN-wise summary of products supplied under this provision.

Documents issued throughout the tax period: This section will contain any invoices issued during the tax period, as well as any type of updated invoice, debit notes, credit notes, and so on.

Frequently Asked Questions On HSN Code

Here are answers to some commonly asked questions on HSN Code:

1. How to add HSN code in tally?

To set this up, go to "Inventory Information" > "Stock Item" > "Create" > "Set/alter GST details" > "yes" in the box next to "Set/alter GST details." On the right side, click the "Tax rate history" button and input the required HSN code.

2. What is the HSN Code in GST?

The HSN code (Harmonized System of Nomenclature) is a 6-digit universal number that classifies over 5000 items and is accepted globally.

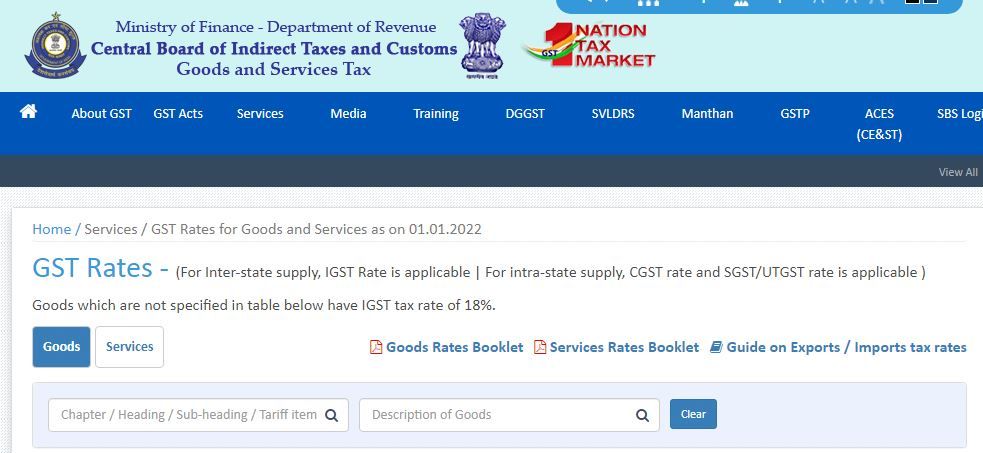

3. How To Find HSN Code Using HSN Code Finder?

You can find HSN Code by using any of these methods:

- Search for a product by its name: Enter the name of your product to get a list of the most relevant four-digit HSN Codes. If the recommendations don't have the correct HS code, search for all results. To acquire details on the 6 and 8 digit HS codes for export-import reasons, as well as the GST rates, click on the 4 digit code.

- Search by HSN Code: Enter the HSN Code's first two or four digits. To learn more about the HSN code, click on the relevant result.

4. How to change HSN Code in tally?

You can change the HSN Code in tally by the following these steps:

1. To access GST Rate Setup, press Alt+G (Go To) > type or pick GST Rate Setup and hit Enter.

2. Using the Spacebar, select the Stock Item/Stock Group > press Alt+S.

3. Set Allow HSN/SAC details to Yes by pressing F12 (Configure).

5. How can I find my product in the HSN list and its relevant HSN Code?

Go to the ministry's website and open the list for GST Rates for Goods and GST Rates for Services to obtain HSN or SAC codes for specific goods or services. HSN/SAC Rate Finder is a feature in GimBooks Accounting Software that allows you to search for HSN or SAC Codes.

6. What is UQC?

UQC is an abbreviation for Unique Quantity Code. In simple terms, it refers to a unit of measurement, such as 1 kilogram of wheat must be written as 1 kg on the invoice, 1 litre of oil must be written as 1000 MLT, and so on.

7. What is UQC in GST?

The Standard Unit Quantity Designation is a one-of-a-kind code used by the Customs Act to identify each commodity. While SQC is the Customs GST-defined list of codes, UQC is the GST-defined list of codes. Taxpayers should only use UQC from the GST Department's list for GST compliance.

8. Who provides HSN Code?

The HSN code is a six-digit universal number that categorises over 5000 products and is accepted worldwide. The World Customs Organization (WCO) created it, and it came into effect in 1988.

Conclusion

We hope this article has helped you give insight into the HSN Code and GST Rate finder. Also, we have tried to solve all your queries regarding HSN Code. We have also answered the most frequently asked questions about GST HSN code and HSN Code Finder with GST rate.

Have a good time reading!