MahaGST: Facts You Should Know About Maharashtra's Online GST Portal

MahaGST: Facts You Should Know About Maharashtra's Online GST Portal

If you want to file your taxes online and your firm is registered under the GST tax system, and your registered address is in Maharashtra, you must utilise the online portal of MahaGST. While the goal of GST is to have one central location where all taxes can be paid, Maharashtra has proposed a settlement mechanism to settle dues under the Maharashtra Goods and Service Tax (maharashtra gst number) Department's different Acts.

Introduction

Implementing the Goods and Services Tax (GST) in India has rendered the old tax structure's cascading impact outdated. Businesses appear to have profited in several ways since its adoption in 2017.

The E-commerce and Logistics industries, in particular, have seen a considerable rise in company efficiency as a result of well-defined taxes legislation. This was not the case under the former tax system, which had perplexing tax regulations that made taxing extremely difficult.

You can use the online portal to make GST payments if your firm has been registered under the GST regime. If you are a Maharashtra taxpayer, go to the online portal of MahaGST for further information.

While some may question the need for a distinct website for each state, consider that Maharashtra recently introduced a settlement system to resolve dues under several Maharashtra Goods and Service Tax Department Act.

Table Of Contents

- What is MahaGST’s online portal?

- What are the services of the MahaGST online portal?

- How to make a profile on the MahaGST online portal?

- What is the GST registration process on the MahaGST online portal?

- What is the GST verification process on the MahaGST online portal?

- MahaGST functions

- Forms under MahaGST online portal

- How to register for PTec in MahaGST?

- How to reset the MahaGST password?

- Frequently asked questions

- The bottom line

Gimbooks is a cloud-based bookkeeping and accounting platform aimed at small and micro-sized businesses that help them create and manage documents (such as GST compliant invoices, waybills, quotations, purchase orders, delivery challans, and so on). It also helps businesses keep track of day-to-day inventory and expenses, manage various business reports, and send payment reminders to customers via mobile and web. GimBooks' major goal is to make business easier for millions of people by delivering a mobile-first, simple-to-use, and inexpensive solution.

What Is MahaGST’s Online Portal?

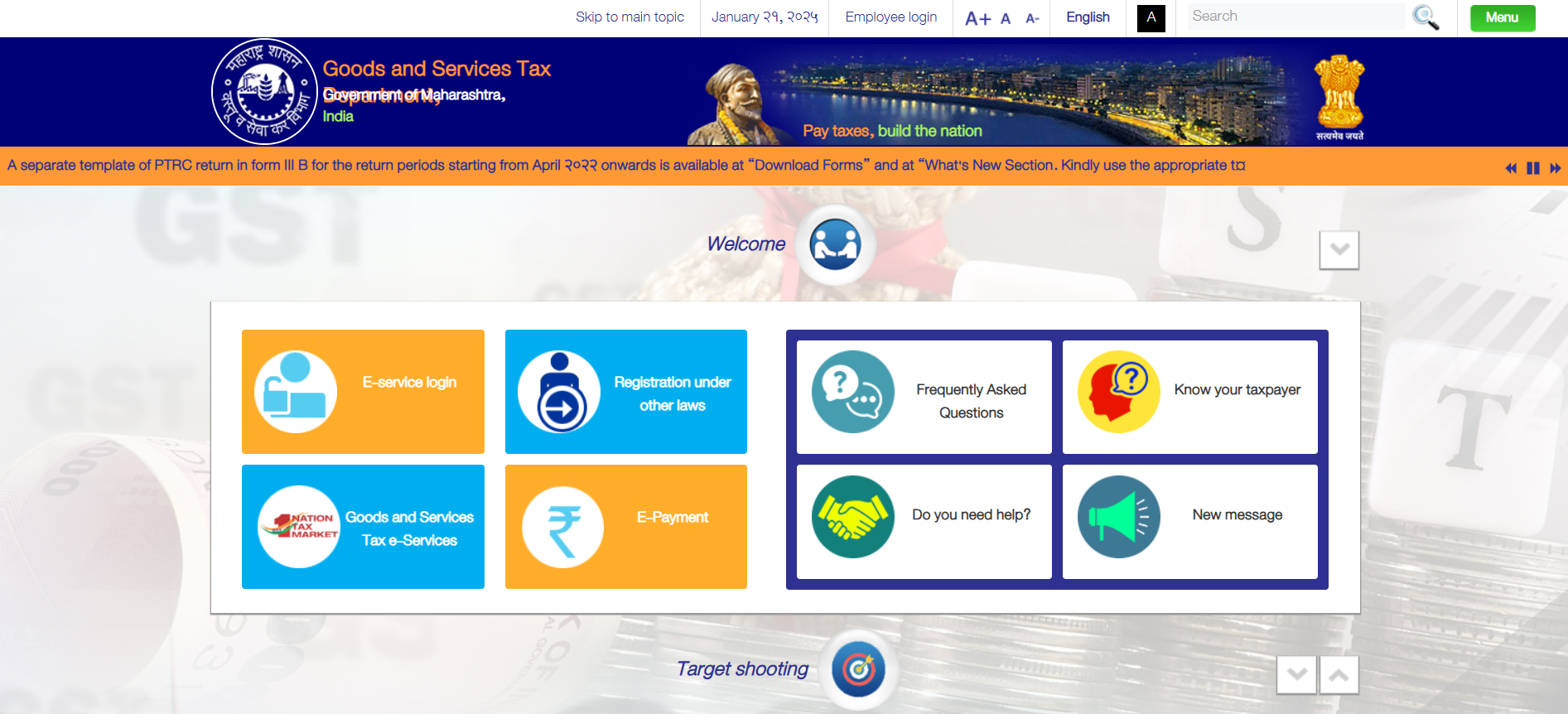

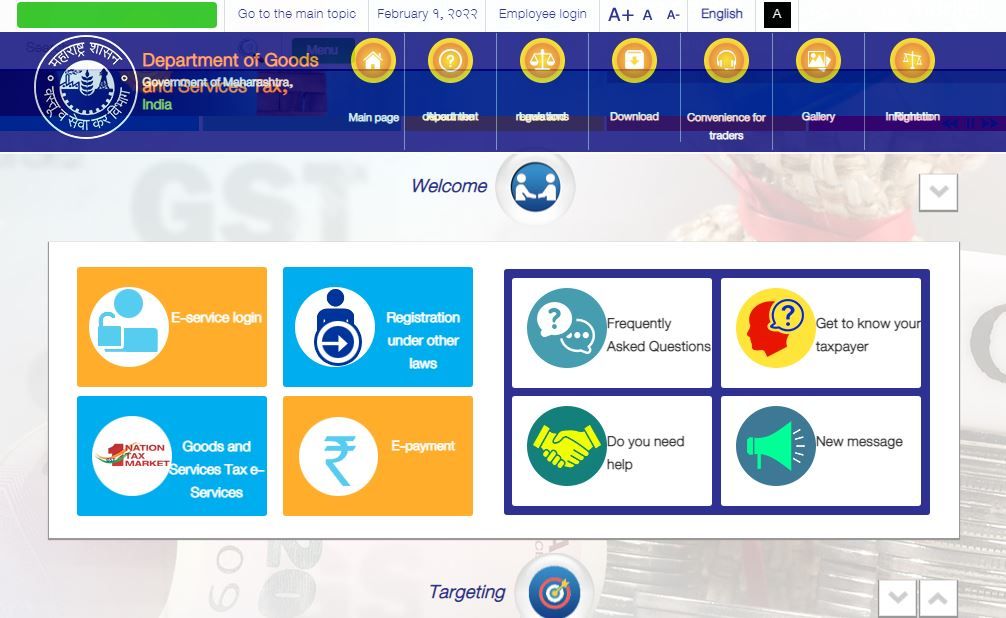

MahaGST is a tax administration and digital (online portal) platform designed to make GST registrations and GST online payments easy for Maharashtra residents and citizens. The online portal of MahaGST contains a wide range of services and features.

The Maharashtra Goods and Service Tax Department has launched the MahaGST Online Portal to digitise the GST payment procedure. It allows taxpayers to save time by making the GST filing and registration procedure easier to do online.

Two big profiles are included on the e-portal - Mr Rajagopal Devara is the Principal Secretary (Financial Reform) of the Finance Department, and Mr Sanjeev Kumar (IAS), the Maharashtra State Commissioner of State Tax.

GST taxpayers can use this online platform to answer their GST registration and filing questions. For Maharashtra citizens, digitisation streamlines the procedure and makes it less burdensome.

What Are The Services Of The MahaGST Online Portal?

The purpose of the web portal is to make GST laws and regulations more accessible to all business owners. It seeks to make sophisticated business operations easier to grasp with only a few clicks or simple mechanics. It facilitates virtual two-way contact via this e-site to achieve the maximum degree of tax compliance. Some of the noteworthy services provided on the online portal of MahaGST are:

* GST Registration

* GST Verification

* GST Rules and Regulations

* GST latest news and updates

* Tracking GSTIN

* E-Payments

* GST Dealer Services

How To Make A Profile On The MahaGST Online Portal?

- A registered dealer can build a temporary profile through "Registered Active Dealer" provided he or she holds an active registration certificate under at least one of the MSTD-administered acts.

- If a dealer has an active registration certificate under PTEC alone and not under any of MSTD's other acts, please go to "https://mahagst.gov.in" and click on "New Dealer Registration," and if your mahagst pan check is not authorised there for the construction of a temporary profile, follow the steps below.

- If a registered dealer has an inactive registration certificate under all MSTD-mandated actions, he or she might build a temporary profile by selecting "Registered In-Active / Cancelled Dealer."

- Only the mahagst.gov.in site should be accessed using the newly established user id and password.

- If a complaint arises during the profile creation process, the dealer must submit a service request using the following procedure: www.Mahagst.gov.in > May I Help You > Service Request. In addition, service requests should include a detailed explanation of the problem.

What Is The GST Registration Process Of The MahaGST Online Portal?

MahaGST allows you to register your business for a GST number if you haven't already. There are several advantages to registering for GST.

- Your firm can become legally recognised as a provider of goods or services by registering for GST.

- Suppose your company files returns and makes GST payments online regularly. In that case, you are more likely to be detected and gain credibility in the eyes of the government and stakeholders.

- The input tax credit process is made easier with your GST number. You can get an input tax credit on the tax you paid on purchases if you make GST payments online regularly.

- To conduct business beyond state lines and expand your market without being constrained by excessive limitations, you must acquire a GSTIN.

What Is The GST Verification Process Of The MahaGST Online Portal?

Given that GST registration is now required for vendors and suppliers, it's unsurprising that a significant number of them are utilising fictitious GST numbers.

To avoid government inspection, many enterprises employ a fictitious GST number. They've gotten away with it so far by sending out invoices with phoney GST figures that appear to be legitimate tax breakdowns.

However, keep in mind that the tax paid by customers does not go to the government. As a result, you must check the GSTIN online to establish the company’s legitimacy with which you desire to link yourself.

GSTIN verification, as previously said, helps you verify the validity of the vendors and suppliers in question, protecting you from being a victim of fraud.

GST number verification has been shown to lower the instances of tax evasion and manipulation, ensuring transparency.

MahaGST allows you to check the GST number you're looking for. Simply go to the MahaGST online portal, click on the 'Dealer Services' link, and input the GSTIN in the 'Know your GST taxpayer' box.

If you don't have a GSTIN but do have a TIN, go to 'Know your Taxpayer,' choose the TIN option, and input the TIN.

MahaGST Functions

The MahaGST is in charge of the following acts:

- The Maharashtra Value Added Tax, 2002

- The Maharashtra Purchase Tax on Sugarcane Act, 1962

- Central Sales Tax Act, 1956, Profession Tax Act, 1975

- The Maharashtra Tax on the entry of goods into local area Act, 2002

The Maharashtra Value Added Tax, implemented in 2002, helped create a more effective and transparent system with benefits such as overall burden rationalisation, price reduction, better transparency, and higher income.

MahaGST also keeps track of the Profession Tax Act of 1975 and the Maharashtra Tax (maharashtra gst number) on Entry of Motor Vehicles into Local Areas Act of 1962.

Forms Under MahaGST Online Portal

There are manual forms that may be downloaded, filled out physically, and sent to the local tax office. Electronic Forms is another tool that allows businesses to file their GST taxes online.

If a company additionally has to pay for VAT or other taxes, the website also has those alternatives. Despite the website's name, one may fill out forms ranging from current GST compliance to VAT and other Acts, as well as past Acts like the Bombay Sales Tax Act, Chit Fund Act, and so on. The online portal of MahaGST serves as a one-stop shop for all types of businesses.

Once you've determined which kind of taxpayer you are, there are many forms available for different sorts of taxpayers. Only the form for the category to which you belong must be completed. According to GST Rule 80, there are four different forms of yearly returns. The following table lists the various sorts of taxpayers and forms:

How To Register For PTec In MahaGST?

- Go to www.mahagst.gov.in to learn more.

- On the main page, click "e-Registration."

- The "Instructions" page will display after clicking on the option "New Registration under different Acts." The instruction sheet contains detailed instructions on the application process flow and a list of essential papers. The "PAN/TAN Validation" information page will show when you click "next."

- The "Temporary Profile Creation" page will appear after that. To establish a Temporary profile, include a valid PAN, email address, and phone number. After successfully creating a temporary profile valid for 90 days, you can apply for online registration with your PAN using the user-id and password you created.

- The applicant will log in using credentials that will serve as a temporary profile. After logging in successfully, the Dealer will pick "Existing Users" from the options menu. The "Act selection" page will open, allowing you to choose which Act registration form is necessary. Dealers can pick numerous Acts for registration on this page.

- In the area "Acts for Registration," choose PTRC/PTEC Act from the checkboxes.

- Professional Act e-application (Form I/II) will be available.

- The form should be filled out completely by typing in the required fields or selecting from the drop-down menus.

- Fields marked with an asterisk (*) are required.

- Before applying for registration, you must have a PAN/TAN.

- The constitution in the form should be chosen according to the PAN.

- If a dealer has selected all Acts, the forms will appear in the following order: MVAT, CST, Luxury, PTRC, SCPT, ET, and finally mahagst ptec.

- Once the shown form has been filled out and submitted, the applicant will be required to enter/select data from unified fields on additional forms.

- If the online application form is incomplete in any way and the needed papers are not supplied with it, the application will be rejected.

- If any of the fields' data is missing, the applicant will receive an error notice and be encouraged to fill in the missing information.

- All correspondence will be sent to the temporary profile’s email address and phone number.

- The applicant should fill in the 'Status of the signatory' section with pertinent information. The application should be signed in the following manner, depending on the dealer's constitution:

- While filing the application and submitting the essential papers, the signatory, manager, or authorised person(s) must sign digitally or by uploading the signature at the appropriate location(s).

- Click the "Submit" button after completing the application form. An acknowledgement with the "Application Reference Number" on the confirmation page will be accessible for download after successfully submitting the Form. The completed application form will be sent to you as a PDF attachment via email.

- Before submitting the application form, the MSTD portal will conduct preliminary verification/validation, including real-time PAN validation with NSDL, Aadhaar No. validation with UIDAI, IGR details with IGR portal, and Electricity bill utilities with respective service providers such as Tata Power, MSEB, BEST, Reliance Energy, and Toronto, and issuance of TIN by MSTD Department through inter-portal connectivity.

- The Maharashtra State Tax on Professions, Trades, Callings, and Employments Act, 1975, as well as the department's rules, notices, forms, and trade circulars, are all available on the department's official website, www.mahagst.gov.in.

How To Reset The MahaGST Password?

Option 1: Dealer can send email from the registered email id only to mvatresetp@gmail.com with the following information:

1) TIN (If issued)

2) PAN

3) Mobile Number

4) Email ID

Option 2: Dealers can also reset passwords on https://mahagst.gov.in/mstd/forgotpass/index.html

Option 3: If the Dealer does not have access to his registered email id, he or his representative can submit an application on original letterhead with a rubber stamp, signed by proprietor/partner/director/authorised signatory to 1st floor, E-Services Helpdesk, New Building, GST Bhavan, Mazgaon, Mumbai along with following documents –

1) Copy of PAN of proprietor/partner/director/authorised signatory for signatory proof

2) Copy of PAN of the firm.

3) If the representative of the dealer is attending, then a letter of authority in prescribed format is mandatory

The Bottom Line

Due to a settlement arrangement proposed and being administered by Maharashtra Goods and Service Tax Department, MahaGST was created independently. The aforementioned are only a few of MahaGST's most important services.

The website offers a wide range of ser Once you've arrived at the MahaGST website, browse through it well because there are so many options and services to choose from that you could miss a few, such as GST alerts and notifications, tracking your application reference, and GST number verification, to mention a few.vices and a wealth of information, and it can answer any business or GST-related issue you may have.

Frequently Asked Questions

1. How to avail MahaGST e-services?

Go to the official website and choose "GST e-services" from the Home page's left tile.

2. Is the MahaGST website available in English?

Yes. By going to www.mahagst.gov.in/en and picking "English" at the top of the page.

3. How Can I file e-returns for the periods before 01-04-2016?

Option 1:- Log in to mahavat for legacy dealers at www.mahavat.gov.in using your current user id and password.

Option 2:- On the left Tile of the Home page, click "Log in for VAT e-services," input your login ID, TIN, and password, and then select "Old e-Services" on the Dealer launch Pad/Dealer Homepage.

4. How to avail VAT e-services on the new Website?

If you registered on or after May 25, 2016, click "Log in for VAT e-services" on the left Tile of the Home page and input your credentials.

5. Why GST is called a multi-stage tax?

- GST (Goods and Services Tax) is an indirect tax levied at each level of the supply chain until it reaches the ultimate customer.

- There are several phases to this, including obtaining raw materials.

- Using raw materials to create completed goods/services, storing them in warehouses, selling to wholesalers, wholesalers selling to retailers, and lastly, retailers selling to end-users.

- Tax is charged at each of these phases, which the client indirectly pays when purchasing the item.

- It is a one-time payment for customers (the price).

- Real estate is likewise subject to a multi-stage GST.