Avoid Penalties: Common Errors in E-Way Bill Generation and Their Solutions

Avoid costly GST penalties with this simple guide on common E-Way Bill errors and their solutions. Learn how Indian MSMEs can fix mistakes, generate correct bills, and stay GST compliant. Practical tips, tools, and FAQs included.

One E-Way Bill error in generating an E-Way Bill can cost you a heavy E-Way Bill penalty.

So, to avoid the most common E-Way Bill errors, let's learn how to fix them and how to avoid penalties. If you're an MSME owner, this guide is your shield against avoidable fines.

What is an E-Way Bill?

An E-Way Bill (Electronic Way Bill) is a document you need to carry when you're moving goods worth more than ₹50,000 from one place to another. It’s a part of the GST system, and it ensures that your goods are being legally transported.

You need to generate an E-Way Bill when:

🚛You send goods outside your city or state

🚛The goods are worth ₹50,000 or more

🚛You're transporting by road, rail, or air

Whether you are a wholesaler in Raipur or a trader in Surat, you can’t skip it.

Why MSMEs Often Face Issues with E-Way Bills

Indian small businesses face many issues with digital compliance, leading to e-way bill errors, and small businesses end up paying e-way bill penalties under GST.

Some common reasons behind the e-way bill penalty:

👎Not fully understanding how the GST system works

👎Typing mistakes in documents

👎Trying to do everything quickly without checking

👎Lack of awareness about penalties

Let’s find the common e-waybill errors that lead to penalties and learn how to avoid penalties.

Common E-Way Bill Errors That Lead to E-Way Bill Penalty under GST

1. Wrong or Incomplete GSTIN

Entering the wrong GSTIN (GST number) of the buyer or seller is one of the most frequent e-way bill errors, leading to an e-way bill penalty.

✅ Solution:

Always copy the GSTIN from the official GST portal

Don’t trust WhatsApp forwards or handwritten notes

Also read: How to generate e-waybill from delivery challan

2. Mismatch in Invoice and E-Way Bill Details

If your invoice says “5 cartons of goods” and the E-Way Bill says “4”, you may attract e-way bill penalty under GST.

✅ Solution:

Match details before you generate the e-way bill

Use software that auto-fills invoice data to reduce mismatch

3. Incorrect Distance Mentioned

If you enter an incorrect distance, like entering 50 km but it's 150 km, this becomes a huge e-way bill error and attracts a huge e-way bill penalty under GST.

✅ Solution:

To avoid penalties for such e-waybill errors, you can use automatic distance calculators, Google Maps, or GST portals or apps like GimBooks.

Update the correct distance before clicking submit

4. Expired or Invalid Vehicle Number

If your vehicle number is entered wrong or the RC has expired, the e-way bill is invalid.

✅ Solution:

Double-check vehicle RC details

Don’t enter temporary numbers or nicknames of trucks

5. Not Updating E-Way Bill for Vehicle Change

Updating the e-way bill for vehicle change is important if your goods are moved from one vehicle to another during the journey.

✅ Solution:

In the E-Way Bill portal, click on ‘Update Vehicle Number’ and update it within 24 hours of changing the vehicle.

6. Wrong Document Type or Document Number

Using the wrong document (like using a delivery challan number instead of the invoice number) is another e-way bill error.

✅ Solution:

Select the correct document type in the drop-down

Recheck document numbers before submission

7. Delayed Generation of E-Way Bill

Some MSMEs generate the e-way bill after the goods leave the departure place. This is illegal, and one of the biggest e-way bill errors that can cost you thousands for e-way bill penalty under GST

✅ Solution:

Always generate the bill before dispatch

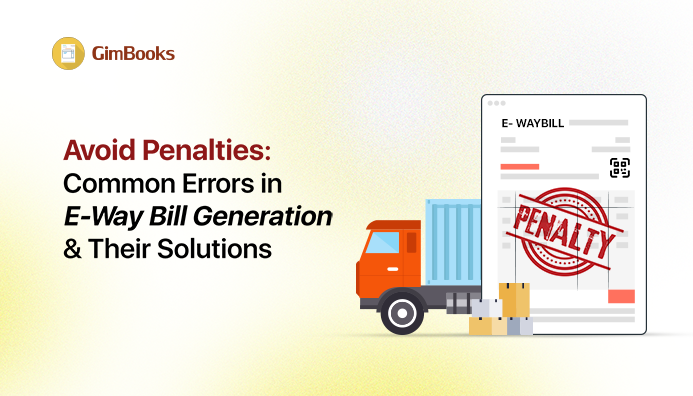

What are the Penalties for E-Way Bill Errors?

E-Way Bill mistakes are not just “technical errors”. They invite real monetary penalties.

E-way bill penalties can include:

👎₹10,000 or the tax amount—whichever is higher

👎Goods can be seized or detained

👎Delay in delivery affects your business reputation

Example: A fabric trader in Bhopal was fined ₹25,000 because of a mismatched invoice in the e-way bill!

How to Avoid E-Way Bill Penalties Easily

Avoiding fines is easier than dealing with them. Prevention is better than paying ₹10,000!

Smart Steps:

✅Always double-check GSTIN, product details, and invoice numbers

✅Train your team to handle e-way bill generation

✅Use tools that simplify the e-way bill process

Simple Tools & Apps to Generate Error-Free E-Way Bills

Many MSMEs now use software to avoid human error. Some apps connect directly to the GST portal and reduce the chances of mistakes.

🔧 Recommended:

GimBooks App: Easy for MSMEs, auto-fills details, tracks transport

GSTN Portal Auto-Tools: Available for free

Accounting Software with GST Support: Tally, Zoho, and GimBooks

These tools reduce documentation errors and improve accuracy.

Why Accuracy Builds Trust

If your records are neat, correct, and on time, it shows that your business is serious and free from e-way bill errors. This builds trust during:

✅GST audits

✅Loan approvals

✅Vendor partnerships

In short, e-way bill accuracy is your business's credibility.

Common Myths About E-Way Bills That MSMEs Should Ignore

❌ Myth: E-Way Bills are only for big companies

Truth: Any business moving goods worth ₹50,000 needs it.

❌ Myth: I can generate the bill anytime

Truth: It must be generated before dispatch.

❌ Myth: Distance doesn't matter

Truth: Distance is directly linked to validity. Wrong info = Penalty.

Checklist for Error-Free E-Way Bill Generation

Here’s a quick checklist you can print and keep in your office to avoid e-way bill errors in future:

✅ Check the GSTIN of the sender and receiver

✅ Match invoice details

✅ Verify product quantity and value

✅ Ensure correct vehicle number

✅ Use the correct document type

✅ Check distance with Google Maps

✅ Generate before dispatch

✅ Update if vehicle changes

Download GimBooks & generate error-free e-waybill formats!

Conclusion

E-Way Bills may look like just another GST form, but they’re super important. One small mistake can attract a huge e-way bill penalty. As an MSME owner, your focus should be on growth.

By avoiding common e-way bill errors and using simple tools, you can save time, money, and stress. Be smart, be accurate, and stay e-way bill penalty-free.

Generate e-way bill easily with GimBooks!

FAQs

1. What happens if the E-Way Bill is not generated on time?

You can be fined ₹10,000 or the full tax amount. Goods can be seized.

2. Can I edit a wrong E-Way Bill after generating it?

No, you cannot edit once it’s generated. You have to cancel it within 24 hours and create a new one.

3. Is E-Way Bill required for intra-state transport?

Yes, in some states and for some goods, even within the state, it is mandatory.

4. How do I calculate the correct distance for transport?

Use Google Maps or auto-distance tools on the GST portal or apps like GimBooks.

5. Are there tools that help reduce E-Way Bill mistakes?

Yes! Many apps like GimBooks or GST-compliant software auto-fill data, check errors, and save time.